I posted this on my bitcoin and crypto Whatsapp group on 20th Feb:

Tether, or USDT, is supposed to be a ‘stablecoin’, always valued at USD 1 because it’s supposed to be backed by actual USD cash reserves. That’s been under question for years now. But it hasn’t stopped the token from being widely traded exchanges and used as part of financial products based on crypto. From a Bloomberg article:

“It has a market capitalization of about $34 billion, according to CoinGecko — but in a sign of how much it’s used in the system, the 24-hour trading volume on Friday was about $107 billion.”

I’m posting this today because of news from earlier this week about a settlement that Tether and Bitfinex, the crypto exchange closely associated with it, reached with the state of New York. The statements made by the state’s attorney-general are pretty damning:

Tether’s claims that its virtual currency was fully backed by US dollars at all times was a lie,” she added. “These companies obscured the true risk investors faced and were operated by unlicensed and unregulated individuals and entities dealing in the darkest corners of the financial system.”

The investigation found that, no later than mid-2017, Tether “had no access to banking, anywhere in the world, and so for periods of time held no reserves to back Tethers in circulation at the rate of one dollar for every Tether, contrary to its representations.”

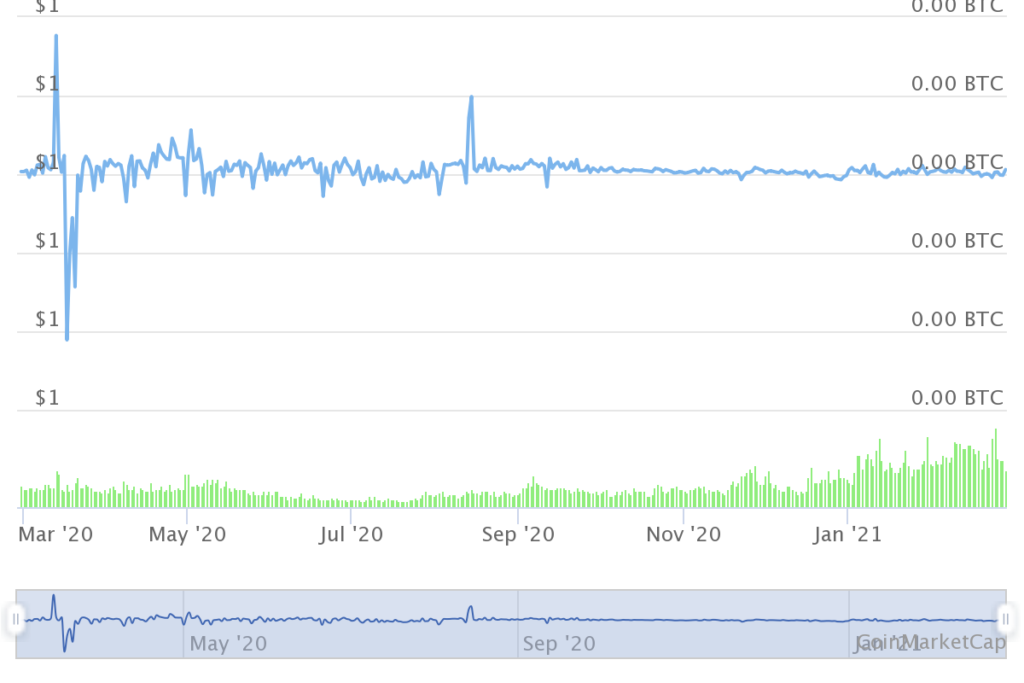

Regardless of this, its trading volumes didn’t fall much (down to USD 93 billion from the high of USD 107 billion in the Bloomberg article above). The price is still ~ USD 1, meaning buyers and sellers still treat it as the stablecoin it claims to be but cannot prove. Here are stats from the industry monitor CoinMarketCap. Blue is price, green is trading volume.

Essentially, if USDTs are simply created out of thin air without needing to be backed by anything, unlike other crypto tokens that need to be mined, and people are fine with pricing it at one dollar, then the company behind Tether is simply a parallel US Federal Reserve – printing money not backed by anything and (implicitly) pricing it at one dollar to every dollar.