The Internet has democratised pretty much anything you can think of. That which is not yet democratised is spending increasing amounts every year to protect its monopoly, whether by force of law or perception.

Democratisation does not mean the end of concentration of power.

The biggest, most powerful companies are the world are tech giants. Whose products have democratised communication, access and opportunity. Those products have produced previously unimaginable social and economic value, and within a generation.

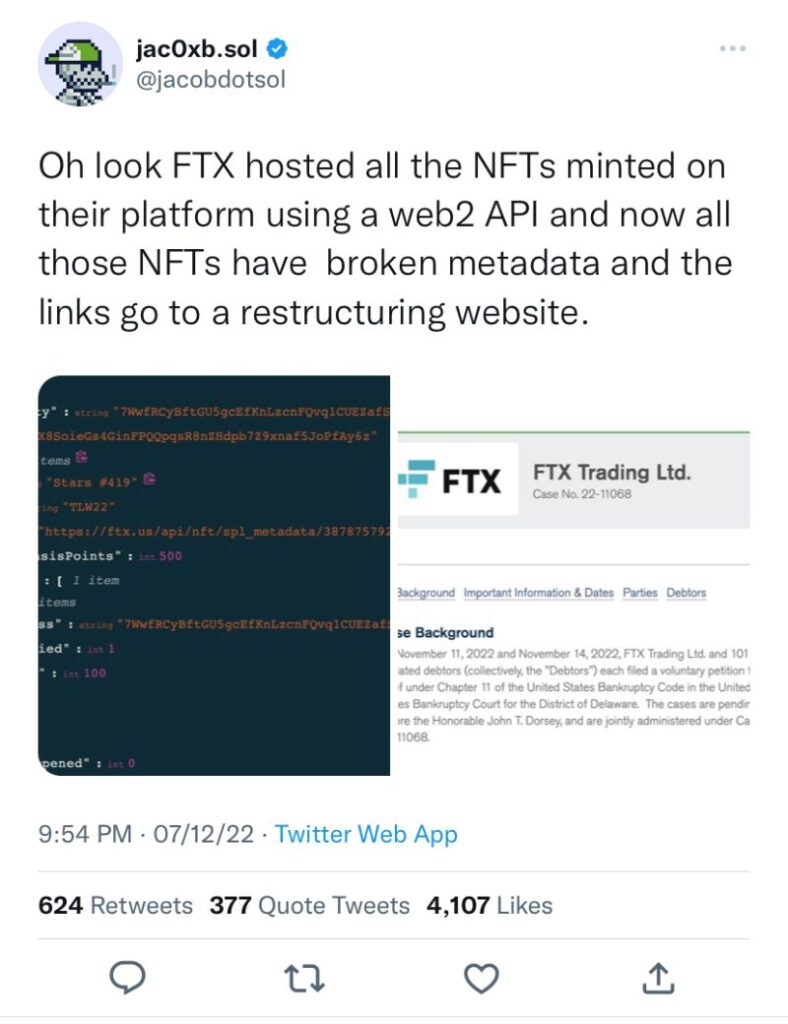

Yet they are, and have been, under investigation for abuse of power. They may have created platforms for creativity, connection, work and play for billions of us, but none of us have any control over these platforms.

A whole other class of powerful companies are financial giants. They have not even democratised access with and to their sophisticated products, unlike tech giants. We aren’t even aware of most of these products.

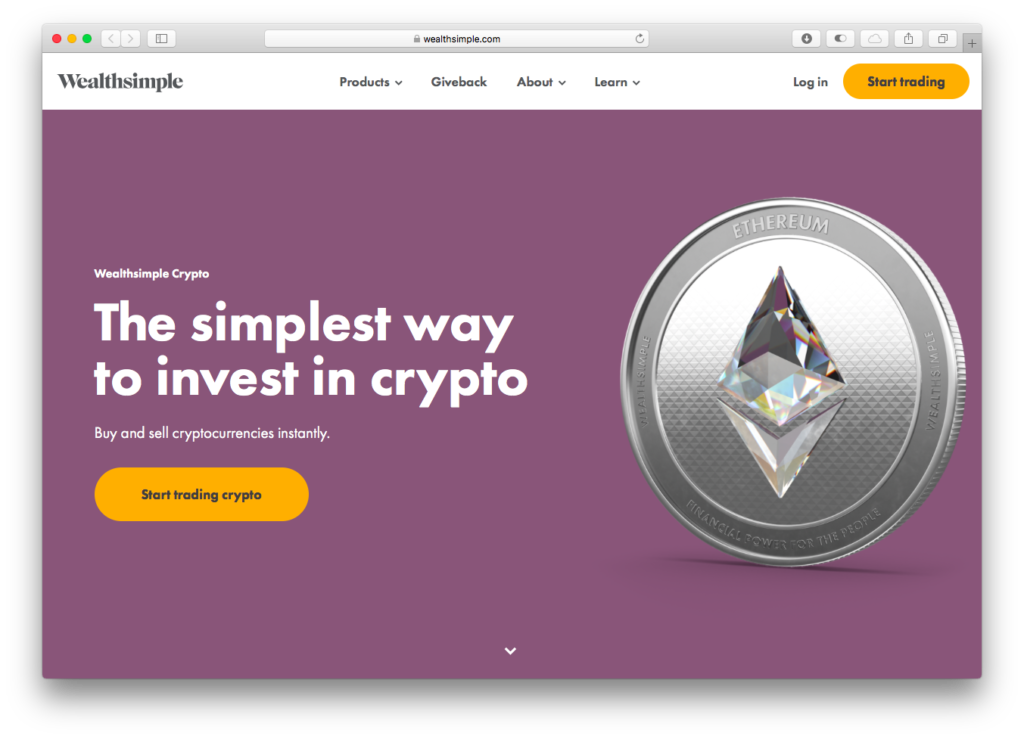

The excitement around cryptocurrencies, DeFi and DAOs and so much other decentralised tech is the promise of both democratisation and agency.

Some months ago a venture capitalist, new to crypto but with a lifetime’s experience of asking the right questions asked me incredulously how it was that anyone could create a new currency. And a new financial product. And a new organisation.

The key is that blockchains are permissionless by design. No one, fundamentally, needs approval to set up any of these above. The genie of trustless transactions let out of the bottle by the original Bitcoin whitepaper cannot be put back. That genie is capturing greater and greater amounts of economic value every year.

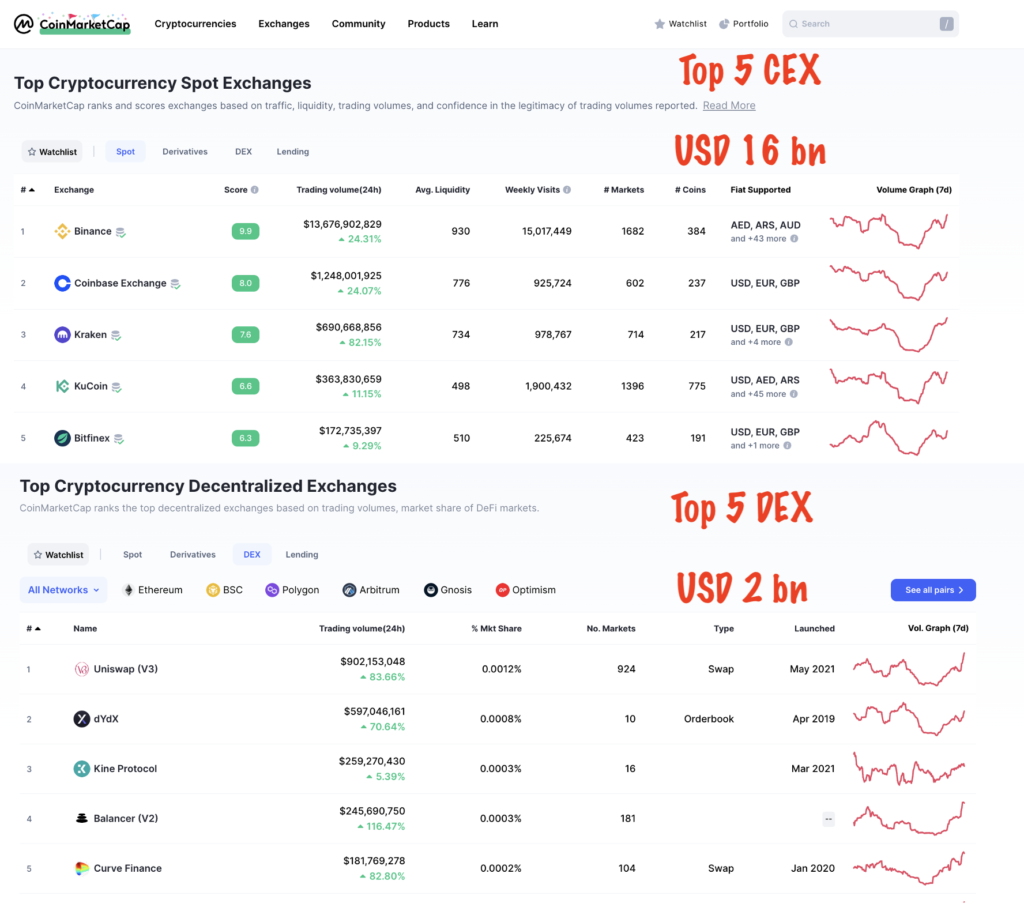

We are already seeing decentralised commerce. Decentralised financial products. Decentralised gaming. Decentralised communities. Decentralised governance. Decentralised creativity. And, of course, the original use case, decentralised currency.

Their success depends not on legislation. Or capital. Or location. Or race. It depends not even on technology, really. It is community, and, by extension, legitimacy. As the founder of the Ethereum project sums up an excellent blog post of his that I strongly recommend you read:

The concept of legitimacy (higher-order acceptance) is very powerful. Legitimacy appears in any context where there is coordination, and especially on the internet, coordination is everywhere.

There are different ways in which legitimacy comes to be: brute force, continuity, fairness, process, performance and participation are among the important ones.

Cryptocurrency is powerful because it lets us summon up large pools of capital by collective economic will, and these pools of capital are, at the beginning, not controlled by any person. Rather, these pools of capital are controlled directly by concepts of legitimacy.

Permissionless systems have lower barriers to entry. Leave alone creating competing systems from scratch, blockchains can and have been forked, preserving information and participation. And for the first time, the community of a project has the agency to act – collectivity – to do so. Because of this, a project must build and preserve legitimacy or risk irrelevance.

No matter how much a traditional tech giant may have democratised access, it is very much permissionned. In some sectors, for instance finance, that permission is regulation by the state.

As this genie of permissionless systems attracts more and more users, as those people move more and more economic activity there, backlash will follow. But both incumbents and regulators will find that permissionless systems, by their very nature, are difficult to rein in.

For tech and finance – and other – giants, the traditional rules of market capture don’t apply. For instance it is difficult for a ride sharing app company to compete for a driver’s loyalty with cashbacks or a reduced commission against a decentralised version that gives the driver actual agency over the organisation itself, that not just allows or encourages collective action, but requires it, cannot function effectively without it.

For regulators, traditional models of regulation may not apply. To begin with, permissionless entities are borderless. They are not just resistant to regulation or opposed to regulation, they transcend regulation. For instance A capital markets regulator in a country may ban participation in liquidity pools, but they will continue regardless. Regulators’ only option, then, is to block the gates to the decentralised world itself, that is, the conversion of fiat versions of value – currency – to decentralised versions of value – tokens. If a decentralised organisation gives someone enough agency, though, they will find ways to access membership of that decentralised organisation. The organisation does not need anyone’s permission to exist, to function, to create value for its members – why should I need permission, goes the thinking.

At the conclusion of this, I must stress that this is not a value judgement. This is not meant to unquestioningly assert the superiority of permissionless systems. It is a thinking-through of what permissionless really means. And, specifically, that it is different from democratisation in the fundamental aspect of distribution of control. It is a pointing-out of why the spread of permissionless systems is likely inevitable, inexorable.