[cross-published to Linkedin]

Why are centralised exchange like Binance, Coinbase and… well, FTX – why are they so addictive?

Because many people trade. Often.

A big draw of centralised exchanges, or CEXes, is how cheap trades are – because nothing’s actually moving other than records on CEX accounting. ‘Transaction’ fees are 24×7 gravy for Binance/other exchanges.

Those same strategies or random trading on an Ethereum decentralised exchange, or DEX, would wipe out wallets balances in the first five minutes with gas.

I can imagine L2 Optimism/Arbitrum/Polygon pools on DEXes like Uniswap or 1inch would have fees low enough to support most strategies even if all trades were on-chain (well technically on a sidechain or a parachain).

But this requires that enough people bridge enough supply to these L2s.

And the issue with the enormous marketing capital and easy, slick web2 experiences on CEXes mean that there’s no significant capital available on these L2 DEXes.

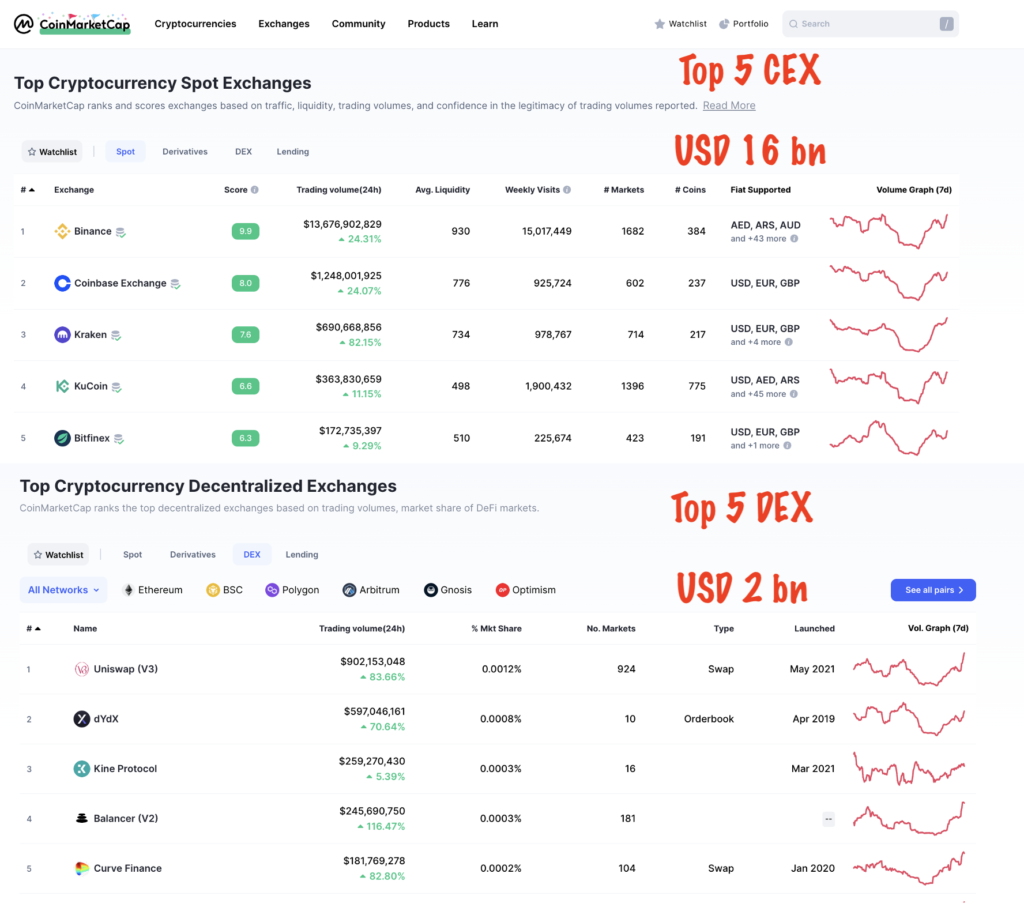

CoinMarketCap Data for trading volumes at the top CEXes & DEXes – that too just spot. Binance is $13bn. The largest DEX protocol, Uniswap v3, with all its cross-pair auto-routing, is just ~$900mn. dYdX is 3/4th that size, the next one is a fifth that.

But let’s face it. Would Joe/Jane Trader simply participate in stuff on the walled gardens of Binance Earn, or would he/she bridge their stables to an L2 and trade there?

The latter is highly, highly unlike as of today.

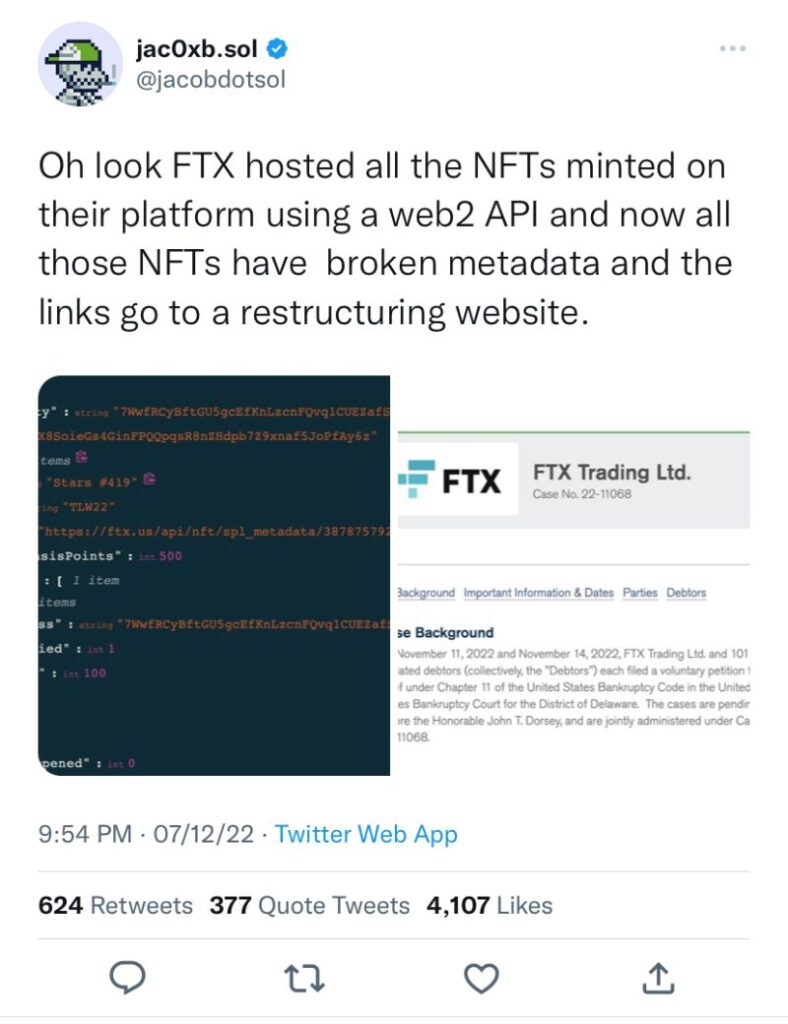

But bridging to L2s and trading on DEXes needs to be the norm, if we are going to move beyond the uncertainty that giants centralised exchanges have presented. Uncertainty about real money belonging to real people.