This isn’t a good time for the crypto world. Not only have millions of people lost billions of dollars to yet another scam, but individuals hailed in the press as prodigies have shown themselves to be the very opposite.

It’s no surprise people now ask whether crypto itself has a future at all. How many more such collapses and scams before crypto finally dies. Whether FTX and Alameda is the final nail in its coffin.

I’ve been involved with blockchain projects since 2017, seen projects succeed and fail, experienced greed and fear at play repeatedly, and I now run an asset management firm in the space. With this background, here is what I think.

Centralised entities are not ‘crypto’

The conversation on web, TV and social media is about the collapse of ‘crypto companies’. This itself is a pretty big misconception.

FTX, Alameda Research, Three Arrows Capital, Celsius, Vauld, Genesis, BlockFi, Crypto.com and so many other entities in the news aren’t crypto projects in any sense.

They’re traditional, “web2” companies that happen to deal with crypto tokens: holding, buying, selling, lending, levering them. They don’t themselves run on a blockchain, and their ‘native token’, if any, is not central to their functioning.

These companies attracted the majority of capital that flowed into the crypto space because they were easy to understand. They abstracted away the complexities of the blockchain and the inconveniences of self-ownership. They presented tokens of crypto projects as casino chips that could be bet on, with elaborately gamified trading experiences.

As it turns out, a combination of lack of regulatory oversight, poor internal processes, insufficient governance, the inherent volatility of crypto tokens and the many complex, invisible interdependencies between such companies has created houses of cards that, every few weeks, seem to collapse, taking billions of dollars with them.

When this does happen, the response is predictable. These companies suspend withdrawals or outright block access to their service. This causes panic selling on other exchanges. Prices plummet, causing other companies to fail – for instance via margin calls, and contagion spreads. There are calls for the heads of CEOs, protection of investor funds and greater regulatory oversight.

This sounds pretty much like the 2008 financial crisis. That’s because it is like it in many ways – nothing has changed in fourteen years other than what’s being traded: crypto tokens instead of mortgages. The only difference here is there are no central banks to bail out either exchanges or ordinary people.

In the specific case of FTX and Alameda Research, a closer comparison here is to Bernie Madoff, who – also in 2008 – was arrested in charges of running a Ponzi scheme. This Twitter thread describes the outright fraud at the exchange and the fund.

So. How have people like you and me not learnt? How have VCs and other funds not learnt? How has the mainstream media not learnt?

The media’s failure to identify these parallels and call them out as such has real consequences. By terming these centralised entities crypto projects, by promoting their founders as the representatives of the blockchain and crypto space, it sent capital their way instead of to truly decentralised, innovative on-chain projects. And when such centralised entities collapsed, all crypto projects were painted with the same brush.

Ultimately, I do think each of these collapses should be publicised, and prosecuted. But they shouldn’t be called crypto projects. Nor should their perpetrators be called crypto founders. They are simply what they are – stories of unfettered greed, deception and fraud operating behind the closed doors of ordinary unregulated companies. Neither the 2008 financial crisis nor the Madoff scandal brought an end to the concept of capital markets. Nor should these.

So where do we – people and institutions – where do we go from here? Personally, I remain as sanguine and excited about a decentralised, permissionless, global blockchain future as I was five years ago. I would rather we go through the phase we are in earlier than later in the journey.

Re-acknowledging what crypto/blockchain/web3 is about

The first step towards the future is to in fact look at the past and acknowledge a fundamental disconnect between the whole point of blockchain/crypto/web3, and the closed systems that we’ve so far associated ourselves with.

The Bitcoin Whitepaper, written in the wake of the 2008 financial crisis, opens with the weaknesses of the “trust-based model”. It then elegantly brings together cryptography, compute power, networks, incentives and a new rationale for intermediary-less value exchange into the idea of a blockchain.

Blockchains have made it possible for the first time in human history for people to

- represent an asset of any kind digitally

- program its behaviour

- exchange it

Without the need for a trusted intermediary for any of these.

This is significant because the story of the world economy is the story of such intermediaries

- Banks that issue credit and take deposits

- Card networks and remittance companies that process payments

- Ratings agencies to manage financial reputation

- Educational institutions to verify credentials

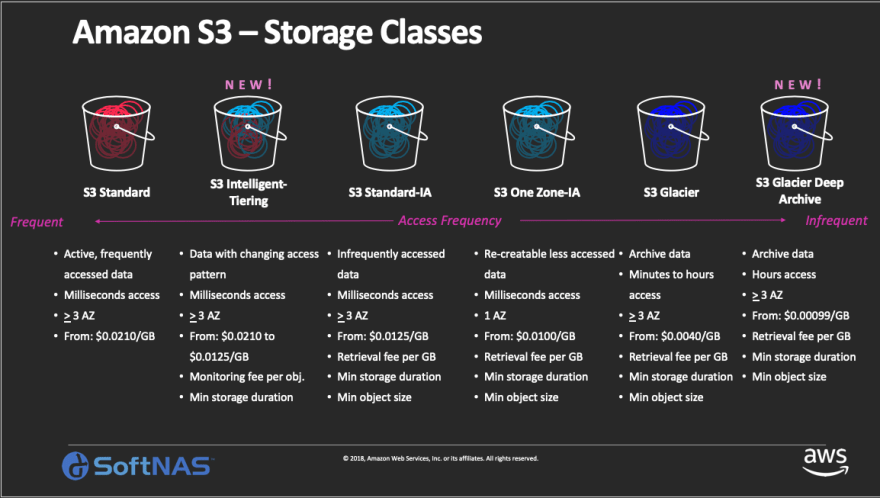

- Cloud providers to hold your life’s private data

- Social media companies to hold online profiles and our public lives

- Marketplaces for real estate, cars, other assets

- And so many many more

These are our brands. These are our icons. These are our trillion dollar market caps.

Such intermediaries enabled today’s global economy and the dramatic rise in standards of living across the world. In doing so, they captured billions of dollars in value facilitating transactions by ensuring trust, taking on risk, providing credit, executing contracts, and so on.

For the first time, it’s become possible to disintermediate many of them. The value unlocked by the disintermediation of these entities, in the trillions of dollars, is now captured by the tokens of the blockchain projects that replace them.

This change has immense consequences for wealth creation:

So far, only selected investors with access were able to share in the value created by and captured by these giant intermediary companies. Even when they went public, usually only people in the country where the company was listed were able to buy shares in that company.

In contrast, anyone anywhere can hold crypto tokens of any project from the very beginning. They do not need permission, and they cannot be locked out of their holdings, and they cannot be blocked from transferring these tokens to/from other people.

This democratisation of value is unprecedented. This is why the genie is out of the bottle and cannot be put back in.

But what we did instead is to replicate the traditional world. To buy, sell, hold our tokens not directly, but through companies like FTX that replicate brokerages like Schwab or Fidelity. We no longer held tokens, we only held a claim on those tokens, a claim recognised only by that black-box entity and enforced by no regulator, unlike with real-world brokerages. We gave up the fundamentals of the blockchain – universality, permissionless and openness – for convenience. Now we ask for greater regulation, but miss the fact that regulation addresses only the symptom, not the cause – after all, “not your keys, not your crypto”.

Once in the closed universe of such centralised exchanges, we began to view tokens of crypto projects merely as items to be traded. The tokens that were most attractive were those that offered the greatest rewards for ‘staking’. That promised the most airdrops for locking-in. The highest returns for lending out (to whom?). That had attracted the most VC funding.

Speculation is an important part of any market, but most of us had lost sight of the fundamentals of these tokens – that there were actual people, products, communities and businesses underlying them.

Over the past years I’ve heard innumerable times people contrasting stocks, which “at least have a real company and business behind them” with crypto tokens, which have “nothing”. This is disappointing, not just because it’s inaccurate but because it means capital flows to tokens that optimise for visibility, while projects building real, blockchain-native products are starved of attention, talent and liquidity.

We’ve acknowledged the past. Now let’s close by looking towards the future. What should we look for in crypto?

A fundamentals-based approach to picking crypto projects

From my earliest days in the blockchain space, I have operated on one axiom:

A blockchain-native project cannot both be successful and have its token price driven entirely by speculation. Only one of them can be true.

In other words, for a blockchain-native project that has real usage, if the value it creates accrues primarily to its token instead of to its cap table, its price will inevitably be driven by fundamentals. Signal will emerge from the noise of speculation.

What are these fundamentals? At a high level,

- Does the project need to be on the blockchain? Centralised exchanges and their native tokens certainly didn’t. Does it significantly improve an existing business or create an entirely new one?

- Is there a revenue model and are proceeds are shared with token holders?

- Is there usage of the product? Can I verify on a blockchain explorer that usage of the application’s smart contract(s) is consistently growing? Note that this is very different from trading volumes of application’s token growing

- Are the founders’ interest aligned with yours? Have they excessively pre-mined tokens? Have they concentrated the project’s governance in their hands? The collapse of the Terra project and its tokens is a stark illustration of the fact that merely being designed as a blockchain-native project is not a free pass to stability, leave alone success.

This requires us to do our own due diligence – not easy in a fast-moving, rapidly evolving space with tens of thousands of crypto tokens already. But it is necessary if we are to avoid repeating our history of speculation. Since on-chain projects are exactly that – on-chain – their contracts, their usage, the holders can all be viewed publicly and audited. This transparency is unprecedented, and we must make use of it.

The alternative is to have someone else perform this due diligence. This is the point of FNDX.

The FNDX Framework identifies which crypto projects have sound fundamentals and whose tokens are well placed to capture the value that is created or captured by the project. Like the crypto space itself, the Framework evolves continuously.

With FNDX’s passive and active strategies based on this framework, individuals and institutions can build portfolio exposure to crypto in a clear, understandable manner. The FNDX 100 is a broadly diversified, passive index strategy that provides exposure to a large majority of the crypto landscape by market cap.

In conclusion

We stand at the end of an era. An era we should be glad to see end. One that saw enormous amounts of capital flow to closed, centralised systems with little to no oversight, with shocking yet inevitable consequences. We now look at the blockchain/crypto/web3 world with hard-earned wisdom.

FNDX has remained focused on the fundamentals. Its bet is that large parts of the global economy will move to decentralised trustless systems that run atop blockchains. Now that the technology exists, it is inevitable.

However, only sound blockchain-native projects will succeed in this new economy. The value they will create and capture will be tremendous, yielding massive potential upside for the token holders of these projects.

Those that are able to identify such projects and hold their tokens in actuality, not by proxy, will create great wealth.

The democratisation of value capture though tokens means this wealth creation opportunity is available to each of us. Having been through what we have, we owe it to ourselves to give it our best shot.

(ends)

Featured image: Philip Myrtorp on Unsplash