You can resist an invading army; you cannot resist an idea whose time has come.

– Victor Hugo

Governments’ reactions around the world to cryptocurrency remind me of this. Everything about bitcoin, by design, was intended to run outside of the existing monetary system. Not merely untouched by it, but also untouchable.

Short of a total internet shutdown, it’s difficult to cut off a region from global blockchains. Even then, tokens in offline wallets will survive indefinitely, like seeds, until they are reconnected.

Bitcoin – and many other cryptocurrencies – have no concept of a central issuing authority, no need for KYC or other identification, no need for a custodian like a bank, no vulnerability to being unilaterally devalued or demonetised.

In short, they strike at any government’s ability to distribute value and tax gains, the one thing more important to it than its monopoly on legitimate violence.

Yet, countries around the world are creating regulatory frameworks for cryptocurrency. Many have created separate agencies to work with the cryptocurrency industry. And it’s not just tax havens whose competitive advantage depends on them being not just receptive but ahead of the curve on financial innovation. It’s major economies whose government departments are learning to live with cryptocurrency.

The USA SEC is creating a standalone office to deal with digital assets.

“Our action to establish FinHub as standalone office furthers our commitment **to facilitate the introduction of new technologies for the benefit of investors **and the efficiency and resiliency of our markets,” said SEC Chairman Jay Clayton.

In the UK, a recent report commissioned by the Chancellor of the Exchequer in 2020 and led by the businessman Ron Kalifa, recommended “a new UK regime for the regulation of cryptoassets”, saying that

The UK has the potential to be a leading global centre for the issuance, clearing, settlement, trading and exchange of crypto and digital assets… the UK needs to act quickly to preserve its position.

The EU recognises that existing regulation “predated the emergence of crypto-assets and DLT. This could hamper innovation.” and is developing something called Markets in Crypto-Assets Regulation – MiCA – which “will support innovation while protecting consumers and the integrity of crypto-currency exchanges”

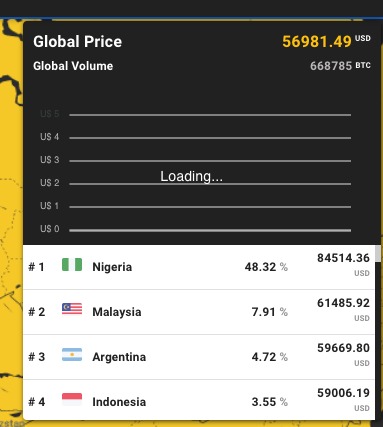

I think most governments, left to themselves, would simply like to ban crypto, likening ownership, distribution and use of cryptocurrency to that of drugs. They’d wage a War on Crypto and drum up public support. This is already happening in India, China and Nigeria where governments have raised the spectre of cryptocurrency being used to fund terrorism and other anti-national activities and have banned it.

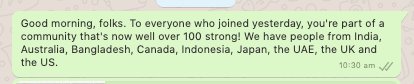

But around the world, cryptocurrency has already reached critical mass (which doesn’t need to be very large). More importantly, financial institutions have seen it as an opportunity to create wealth and generate new buseiness In today’s finance-dominated era, these institutions are politically important enough for cryptocurrency to gain, if not outright legitimacy, then at least a guarantee of survival.

It is the idea whose time has come. At least for those that matter.