This is a draft of a post I wrote for Cube Wealth, where as of this writing I’m the chief operating officer.

We’re not taught personal finance well enough in school. Not even close. That’s why most of us start our adult working lives without a healthy relationship with money – I did too. It’s not even a subject taught at the best business schools in the country. This results, strangely, in highly paid MBAs working in banking and high finance who manage their own finances poorly.

I feel strongly about this, which is why I’ve been at Cube Wealth from Day One of its existence helping people invest well – it goes without saying I’m a customer as well. During this time I’ve been fortunate to spend time with some of the wisest and most successful investment advisors in the country. From what I have learnt from them, I’ve pieced together five exceedingly simple rules to build a low-overhead investing habit that creates wealth for you and your family. Here goes:

1. Start. Today.

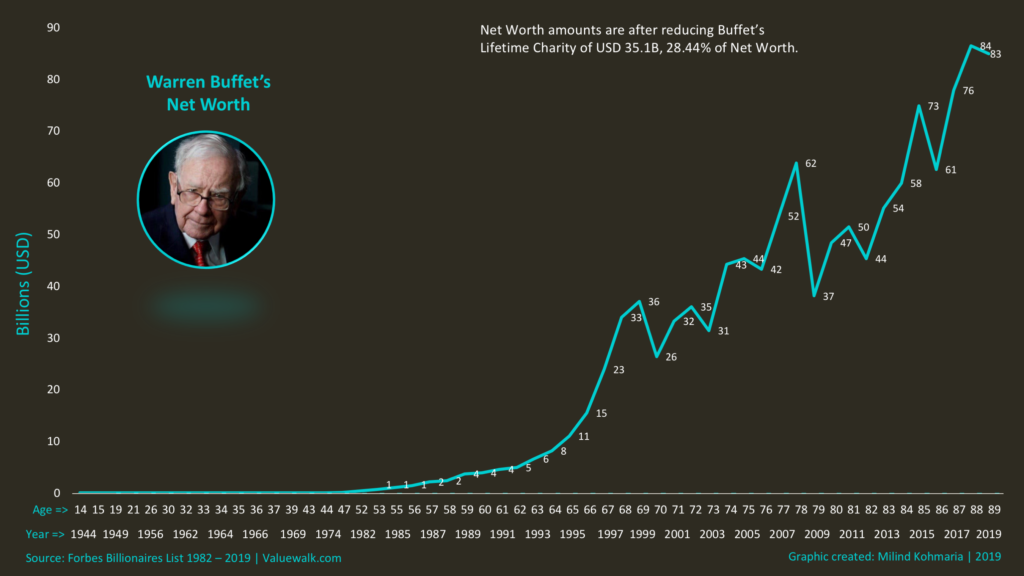

“The best time to plant a tree was twenty years ago. The second-best time is now” is a proverb as old as time itself. It is especially true for investing because money compounds: when left untouched growing at a steady rate, your money accumulates faster the longer it stays invested. Look no further than the grandmaster of investing, Buffet. This Morningstar article charted the growth of his wealth over his lifetime:

The kicker is at the end of the article:

Warren Buffet made his first investment at the age of 14. Had he started investing late, say after 5 years, what is the kind of money he would not have made? The answer. The wealth bars missing would be the last five!

2. Pay Your Future Self First

You’ll always have outgoings during the month: there’ll always be bills, there’ll always be something you’ve been wanting to buy for a while, always something you have to gift. You can budget all you want, but in reality your month’s expenses follow Parkinson’s Law: they expand to fill available space. To make sure you invest regularly, invest a set amount of money the day your salary or income hits your bank account. What’s left is yours to spend. Your future self will thank you.

3. Set Yourself Up for Success

So now you know that you should invest before you spend your monthly income. But doing that every month gets tiresome very quickly. The well-known financial writer Ramit Sethi describes how he makes it easy for himself: he has one bank account that everything flows into, like an email inbox. From there, he moves money into a separate investment account. I’ve done the same thing: at the beginning of every month, I make one single instant UPI transfer from my salary account into another investment account. Out of sight, out of mind. If you have fewer control issues than I do, you can automate this and simplify your life by setting up a recurring transfer on a particular date of the month. Some banks call this a standing instruction. Make it easy for you to be good.

4. Get a Coach

At this point, you’ve automated the movement of your monthly investment amount into a separate account so you don’t end up spending it. The next most important question you ask yourself is where to invest your money.

The correct answer is Don’t. Don’t decide where to invest your money. Leave that to a professional investment advisor. Not just because they will likely do a much better job at it than you, but because you have a career to pursue, hobbies to explore, places to see, family and friends whose company to enjoy. Unless you find joy in investing – in which case you probably wouldn’t be reading this – spend time picking the right investment advisor, not actually investing.

That is the whole point of Cube: to give people like you and me access to the investment advisors that so far only the rich have had access to, so you can live your life worry-free.

5. Fill it, Shut it, Forget it

Never before or after has a motorcycle ad imparted such wisdom. The idea is simple: don’t touch your long-term investments once you’ve made them, no matter what the markets say or what your immediate financial needs are. In his 1994 shareholders’ letter, Buffet had this to say:

We will continue to ignore political and economic forecasts, which are an expensive distraction for many investors and businessmen. Thirty years ago, no one could have foreseen the huge expansion of the Vietnam War, wage and price controls, two oil shocks, the resignation of a president, the dissolution of the Soviet Union… none of these blockbuster events made the slightest dent in [Buffet mentor] Ben Graham’s investment principles. Nor did they render unsound the negotiated purchases of fine businesses at sensible prices.

Too often I have seen people, including friends and family, treat their investments like a personal expense account. They are profligate when times are good, dipping into it to make gadget, vacation and other purchases, only to then panic when times are bad when markets fall.

That shouldn’t be you. Don’t use your long-term wealth chest for short-term stuff. First get good life and health insurance for yourself and your family. Then set up an emergency fund for 3 to 6 months of your typical monthly expenses. And save systematically for expenses you know are coming up in the next three years. Hand over everything surplus to your advisor.

Look at the five rules again. Start today. Set aside money for investments before you spend. Automate this. Let a professional handle the actual investment. And don’t touch your money as it compounds. None of these is complicated. None of these requires advanced financial know-how.

All it requires is a commitment to build a good habit.

Good luck.