US financial markets had a remarkable year even as the economy struggled with business shutdowns, layoffs and unprecedented jobless claims in the wake of the pandemic.

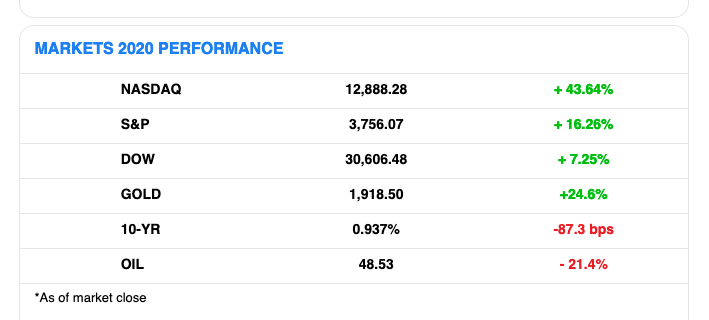

This screenshot is from the 4 January issue of the excellent Morning Brew newsletter:

The New York Times tried to explain this disparity by looking at income and spending:

The millions of people no longer working because of the pandemic were disproportionately in lower-paying service jobs. Higher-paying professional jobs were more likely to be unaffected, and a handful of other sectors have been booming, such as warehousing and grocery stores, leading to higher incomes for those workers.

and

The obvious part was a decline in spending on services: All those restaurant reservations never made, flights not taken, sports and concert tickets not bought added up to serious money. Services spending fell by $575 billion, or nearly 8 percent.

– “Why Markets Boomed in a Year of Human Misery”

However, to me this isn’t the full picture. The article makes little attempt to show that the net savings were invested:

… for those a little more comfortable with risk, there was investing in stocks, which helps explain the 16 percent rise in the S&P 500 for the year. For those comfortable with a lot of risk — and with taking advantage of the market’s momentum — there was buying a market darling stock like Tesla or trading options.

In any case, retail investors – people like you and me – make up a small part of the markets, according to this Bloomberg TV video quoted by Business Insider:

Retail investors now account for roughly 20% of stock-market activity on average and nearly one-quarter of trades on peak days, Joe Mecane, the head of execution services at Citadel Securities, said… Individual investors made up just 10% of the market’s trades in 2019. That share then crept to 15% as popular brokerages including E-Trade, TDAmeritrade, and Charles Schwab erased their commission fees…

80% of the investment in the financial markets is institutional money. Those sort of people didn’t have their lifestyles affected in the same way as retail investors did. Institutional investors may have been spooked by the pandemic, withdrawing money in February and March, but they dove right back.

So what drove the markets’ performance this year?

Tech did.

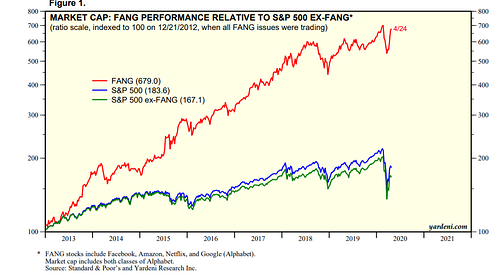

See this chart of the performance of the S&P 500 index with and without FANG: Facebook, Amazon, Netflix and Google.

This isn’t just a 2020 phenomenon. As the chart shows, a few tech stocks have both outperformed the rest of the market and have ballooned in market cap enough to have an outsize impact on the overall S&P 500 index performance.

This past decade is when tech giants overtook energy and manufacturing companies as the US’ largest corporations. A comparison of the world’s top ten largest companies by market cap in 2010 and 2020 makes this clear:

Of the 2010 top ten, five were in energy, two in finance, two in tech, and Nestle, the food/beverages multinational.

In 2020, nine out of ten were tech companies. One was the Berkshire Hathaway holding company. The only two tech companies in the 2010 list, Apple and Microsoft, are, in 2020, the world’s two largest companies.

The companies that have posted some of the highest gains in 2020 are all those tech companies that have directly or indirectly enabled our shelter-in-place pandemic-suffused lives – Zoom (up 425%), Peloton (439%), Shopify (166%), Spotify (111%), Twilio (220%), among others. And of course the FANG stocks above + Apple.

In 2021, as the US opens up after mass vaccinations, not everything will go back to how it was. There have been irrevocable lifestyle changes. There will be other, newer companies that capture the spends from these changes – Airbnb, perhaps, as the normalization of remote work means that people choose to work from, well, remote places a few weeks at a time. Potentially Zillow and Opendoor as property owners shift their holdings from large cities to smaller ones that are more likely to attract such short-term relocations.

End note: The stock market isn’t the economy and vice versa. Anyone who conflates them is uninformed at best and disingenuous at worst. However, it’s clearer than ever that the gap between the markets and the economy will likely remain: there are only a few companies that are likely to disproportionately shape our lives over the next few years. As these companies do well, their stock – having attracted ever more money – will do well too. And since these companies are also among the largest on the stock markets, the overall market will perform well too.